Retirement

The Retirement module allows you to model how long your clients’ funds will last in retirement.

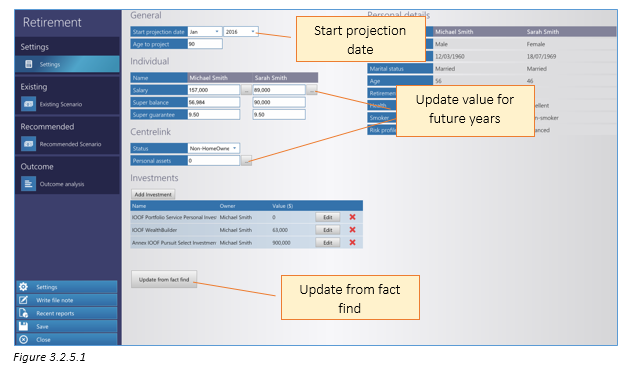

Settings

In the settings menu you can view client information, set the projection start date and amend any information needed for your analysis.

To ensure the most up to date information is captured before you start your clients’ retirement Modelling, click “Update from fact find”.

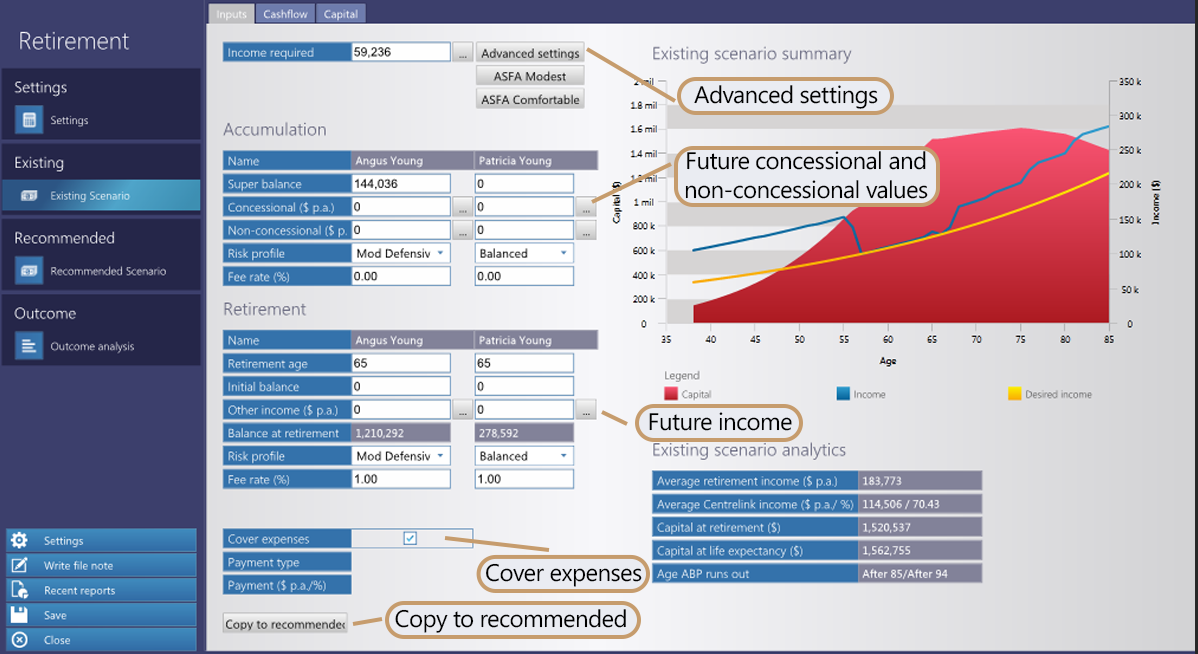

Existing Scenario

The input tab shows the existing scenario for retirement. In this screen you can make amendments to income required as well as make current and future value concessional and non-concessional contributions.

To make changes to existing scenario for investment strategies, access “Advance Settings” to set surplus and/or deficit allocation. To copy existing scenario into recommended, click “Copy to recommended”.

The Cashflow and Capital tabs show the existing cashflow and capital projections.

Figure 3.2.5.2

Recommended Scenario

The recommended scenario works in an identical way to the existing scenario and any changes can be made in the same manner as in the previous section.

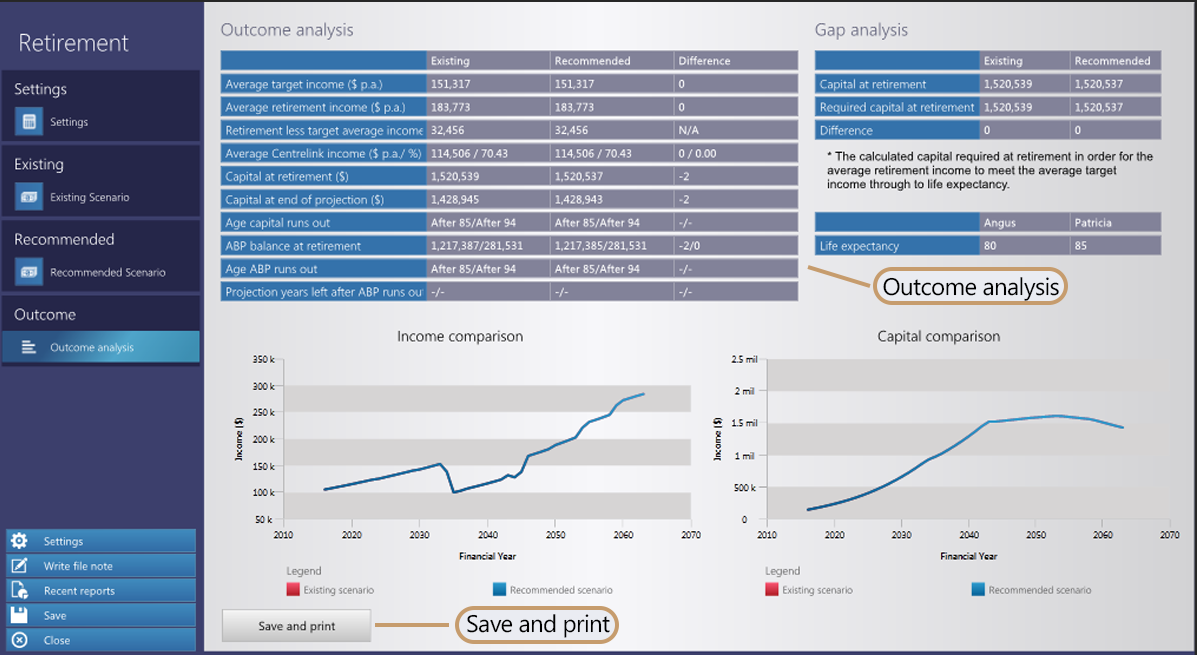

Outcome analysis

The Outcome analysis shows a comparison of the existing and recommended retirement scenarios and a graph for both Income and Capital comparison.

Figure 3.2.5.3