Portfolio Builder

Portfolio builder is available in the product comparison modules as well as in the platforms and investments module.

Portfolio builder has a several features, enabling you to allocate investment options for your clients’ assets and select model portfolios.

You are able to access Portfolio through the super, pension and investment tab in the edit client module by clicking “Options” when entering your clients’ investment options in each structure.

You can also access the Portfolio builder in all product comparison modules by clicking the Sell/Buy spread or ICR/MER buttons on both existing and recommended platforms.

Each platform contains a platform average investment option. The average platform contains the average MER and asset allocation of all the underlying options in each platform. Note that when using the average investment option it is not a true reflection of any actual investment option and should not be used in any final analysis.

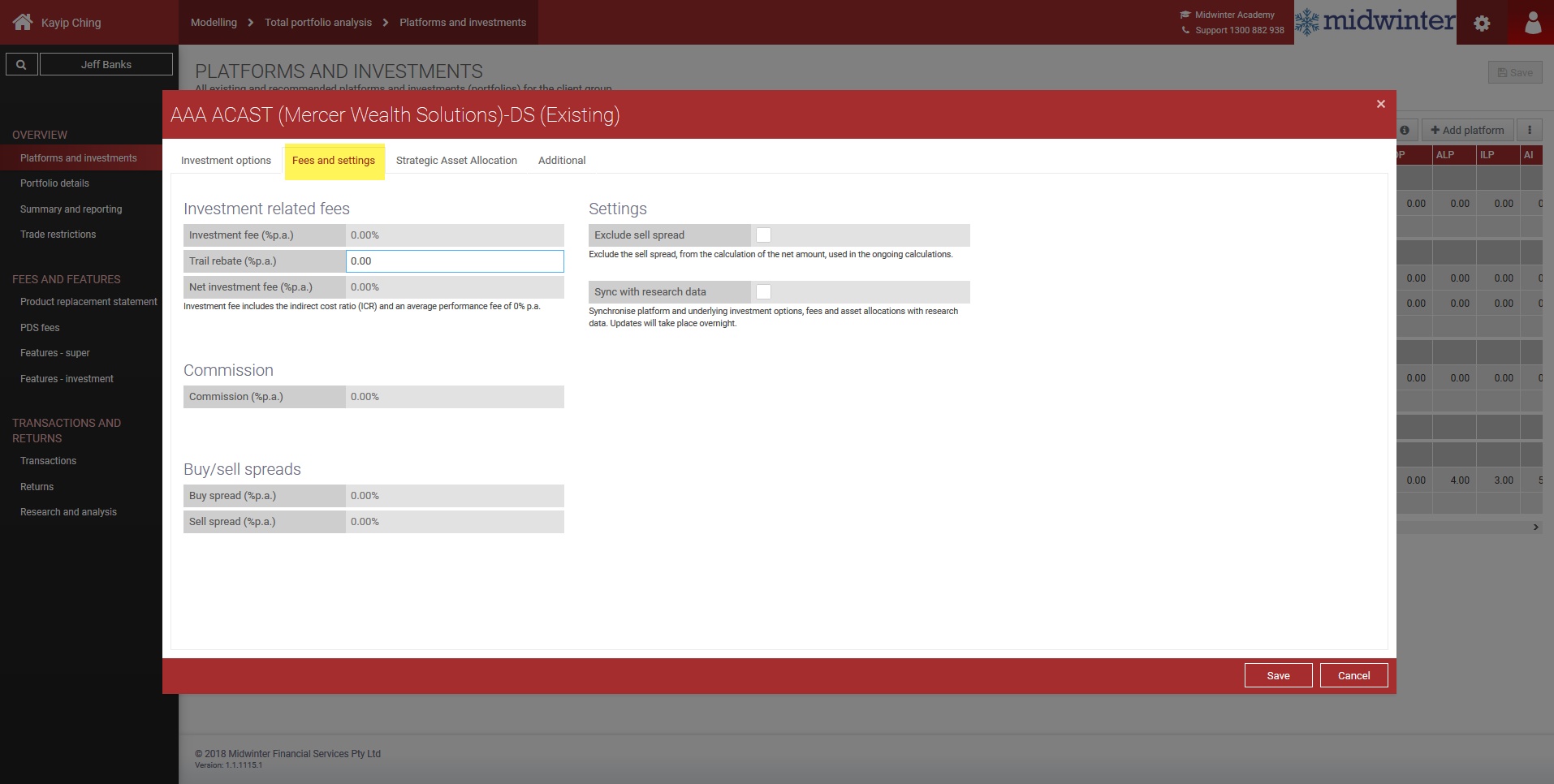

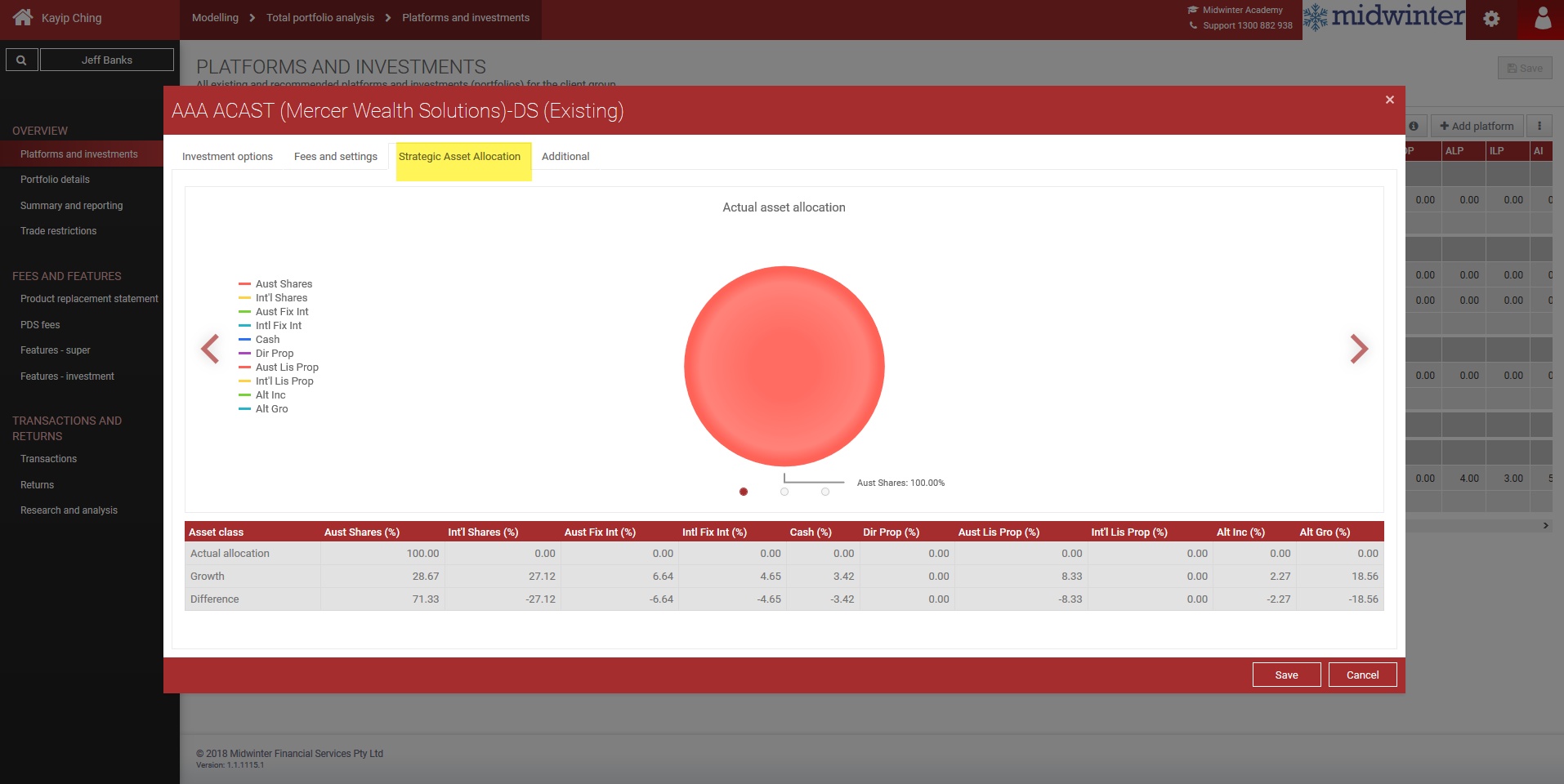

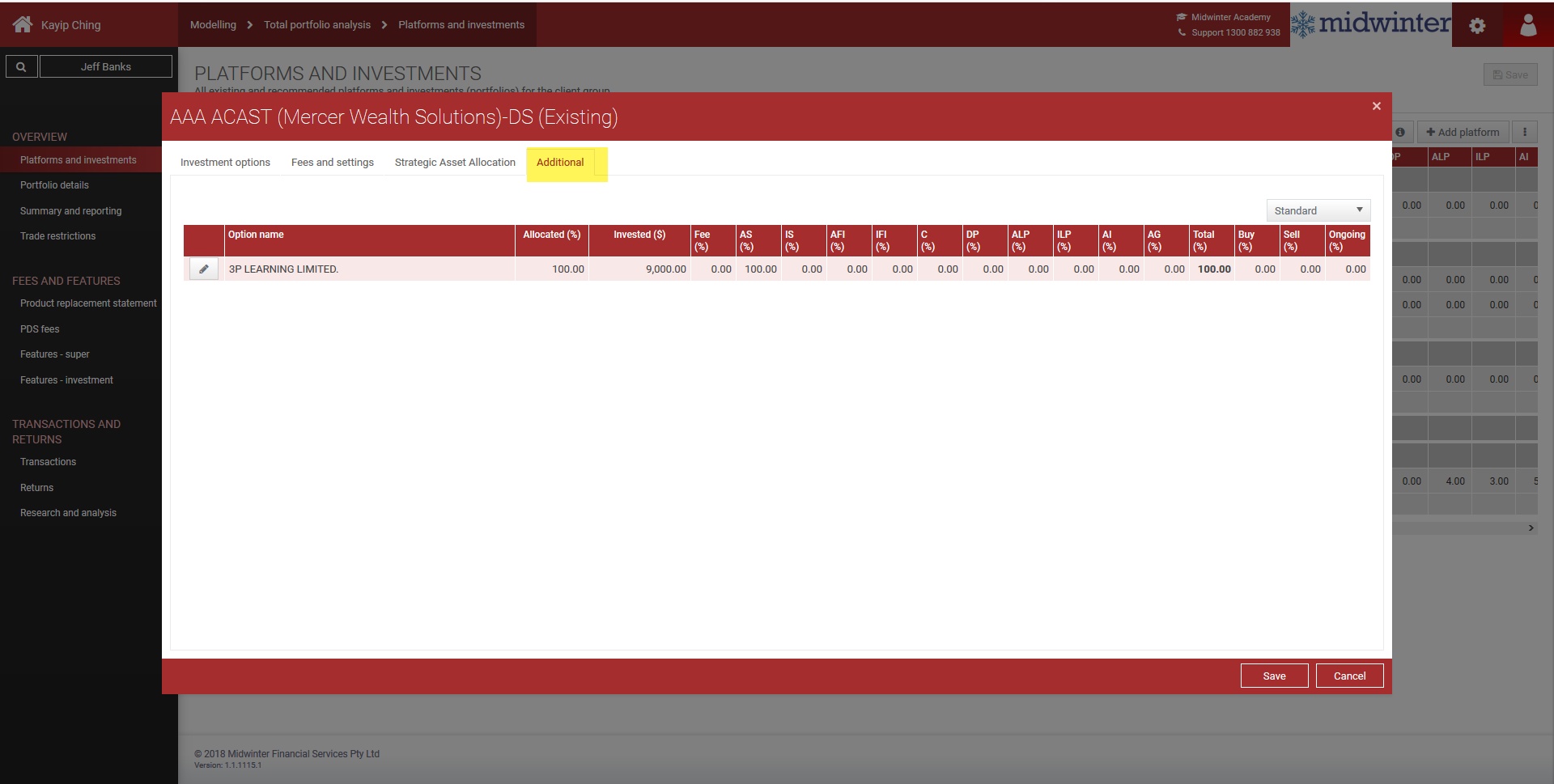

In the Strategic asset allocation section on the bottom part of Portfolio Builder, you can view your clients risk profile and the variance to the risk profile with the actual allocation of assets. In this section you can also view the weighted average cost of each of your client’s investments in the MER related fees along with Buy/Sell spreads and Commission.

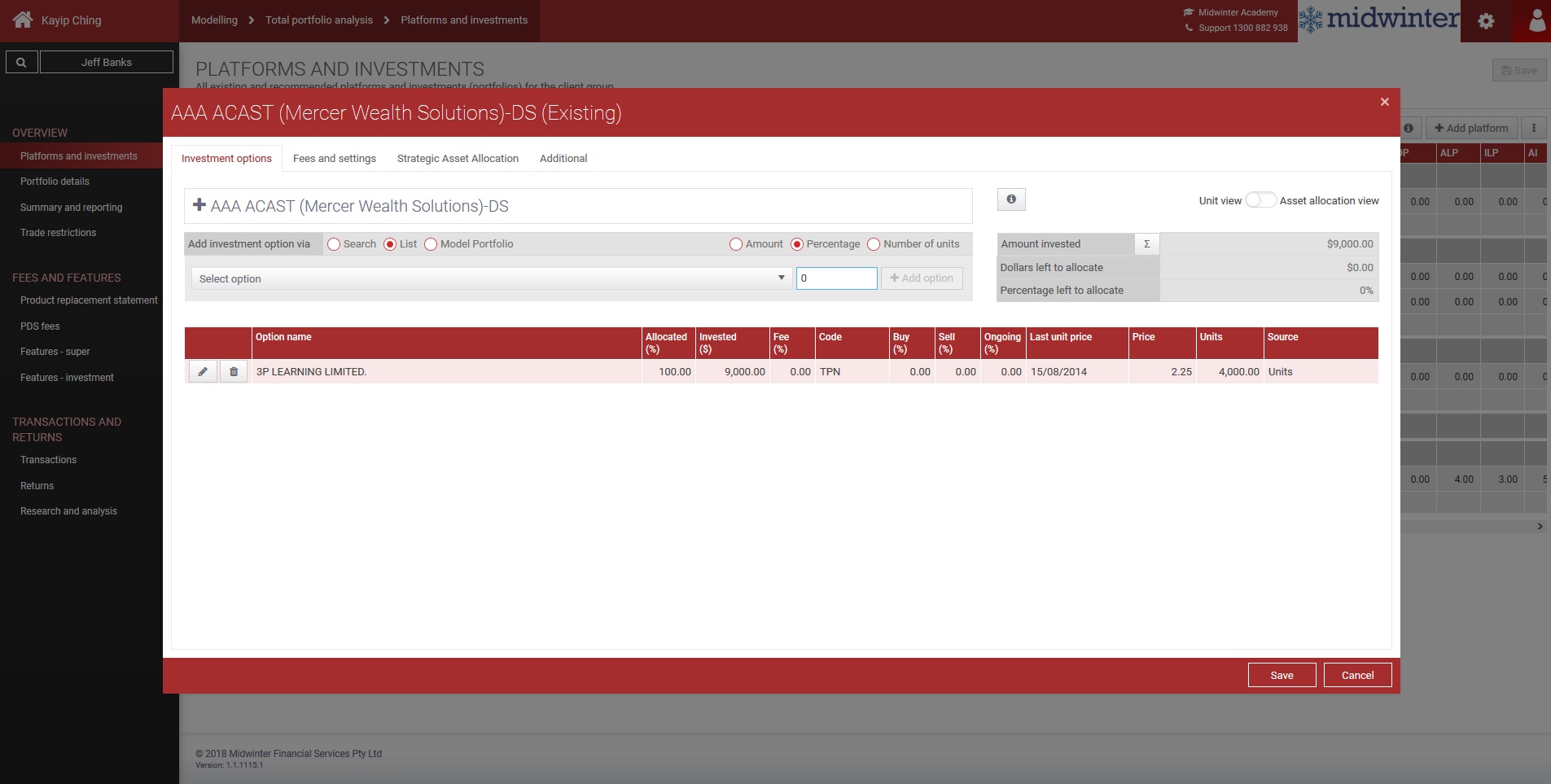

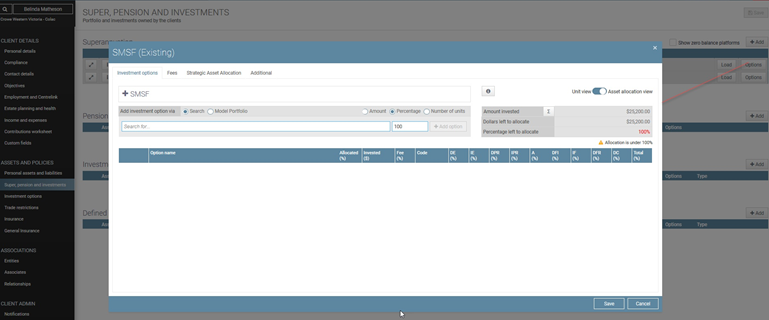

Selecting investment options

1.Click dropdown menu to select investment options

2.Click on the percentage button to choose percentage or dollar value for each investment

3.Add value for investment

4.Click “Add option” to select additional investments

5.View “Percentage left to allocate in investment options”- asset allocation must be 100%

6.To use the multi select tool to add investment options and amounts in percentage or dollar amount, click “Multi select”

Select model portfolio

1.Click “Model Portfolios”

2.Select model portfolio

3.Click “Insert model portfolio”

4.Click “OK”

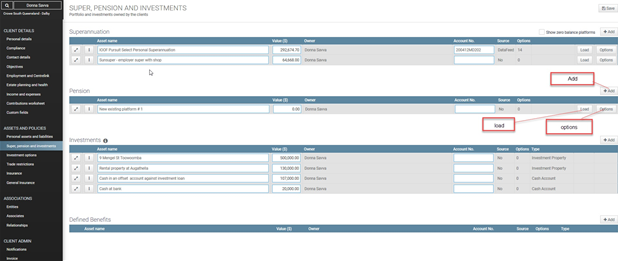

Adding details to the Pension structure

1.Click” Add”

2.Select owner (if part of a couple)

3.Click “Load” to view and select preloaded platforms or custom platforms should they be available. If the platform isn’t preloaded in the database, double click the Asset name field and enter name

4.Enter value of the pension fund

5.Click “Options” to enter Portfolio Builder and select the investment options and asset allocation for the product selected (for more information on Portfolio builder, see separate section of this document)

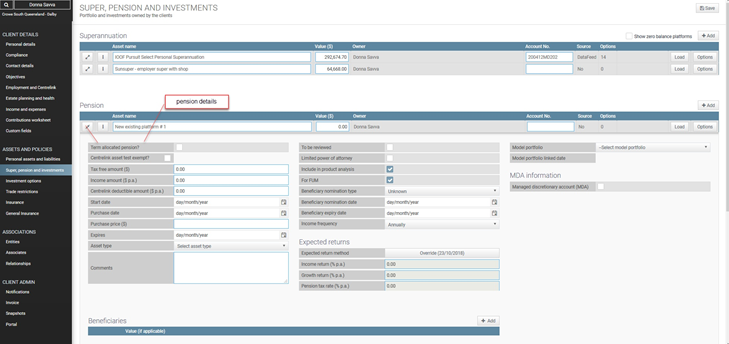

6.Click on “More” to enter Pension Details

7.Enter “Tax Free Amount” to calculate tax free amount between ages 55-59

8.Enter the pension drawn down rate for this pension in “Income Amount”

9.Add any Beneficiaries in the same manner as in the superannuation structure and set an expiry date should you require an auto task to be triggered.

10.Click “OK” and “Save”

** User note: To add a file note related to a specific product in the structures, click the file note button next to the product

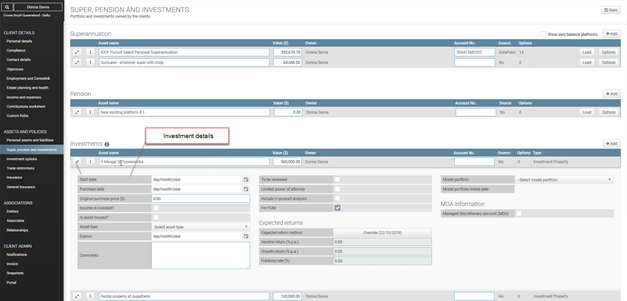

Adding details to the investment structure

1.Click “Add”

2.Select individual or joint investment owner and investment type

3.When selecting Holding (product), a “Load” button appears and preloaded investment platforms or customer platforms (if available) can be selected.

4.For all other investment types, double click the asset name field to add name and enter value of investment

5.Click “Options” to enter Portfolio Builder and select the investment options and asset allocation for the product selected (for more information on Portfolio builder, see separate section of this document)

6.Click “More” add Investment details and any Beneficiaries in the same manner as in the other structures and set an expiry date should you require an auto task to be triggered.

7.Add any relevant comments and click “OK”

To use investments in product comparison TPR, select Holding (product). All investments can be imported into Cashflow and Capital but only Holding (product) investment types will appear in TPA and Invest to Invest modules. Click on information button for further information.

** User note: Only add beneficiary should you need to utilise this as part of your clients’ estate planning.