Online calculators

As with the details (fact find sections) the calculators are the same for the adviser and the client (Adviser changes go directly into the live client in the AdviceOS database – the client calculators are snapshotted – and can be made live at the adviser’s discretion).

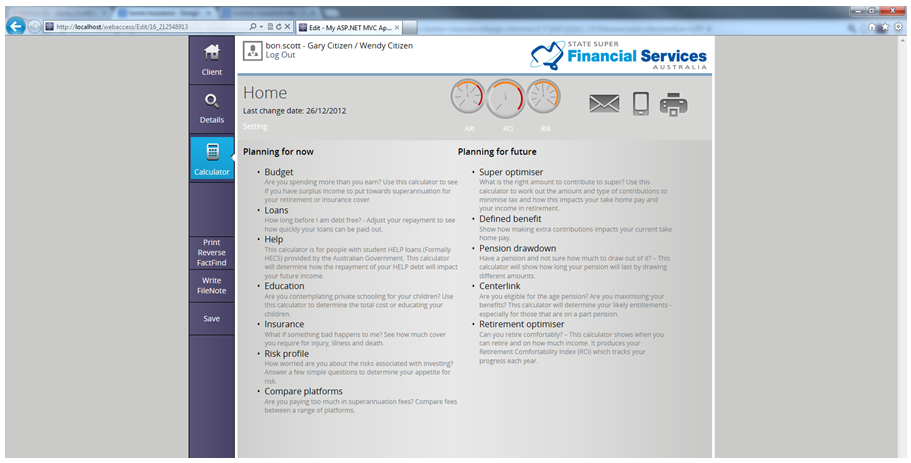

Calculator home page

Provides access to each of the calculators with a short description of each one.

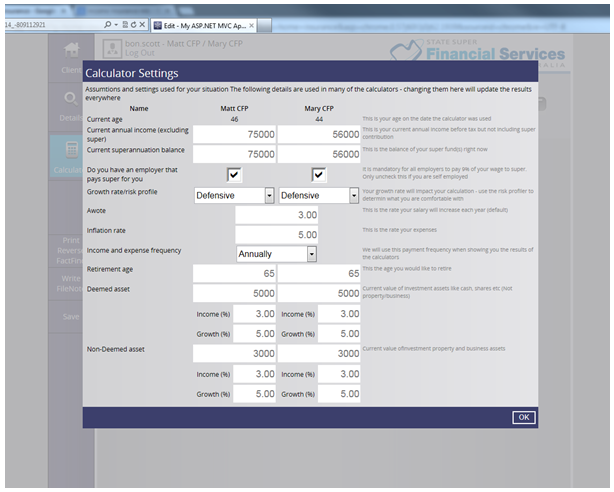

Calculator Settings

These settings flow through all the calculators and are available in each screen.

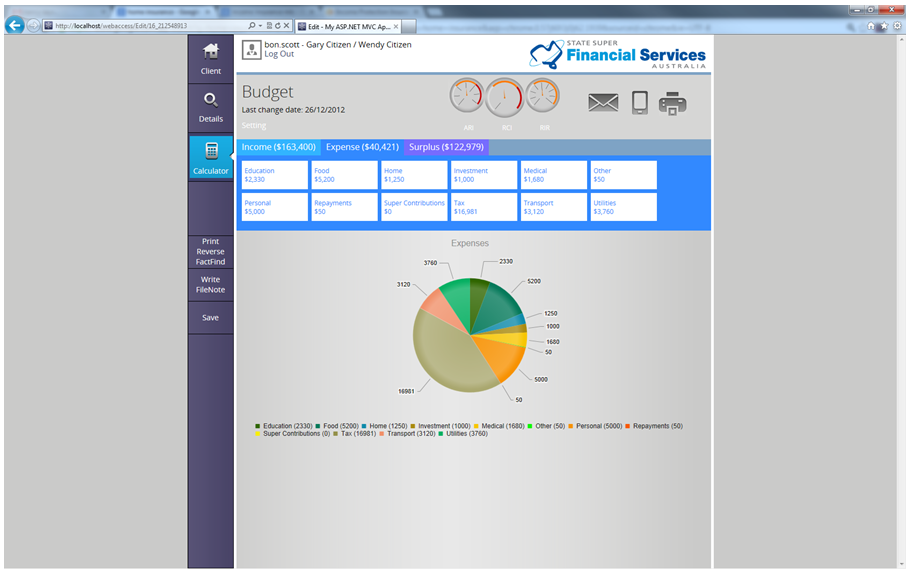

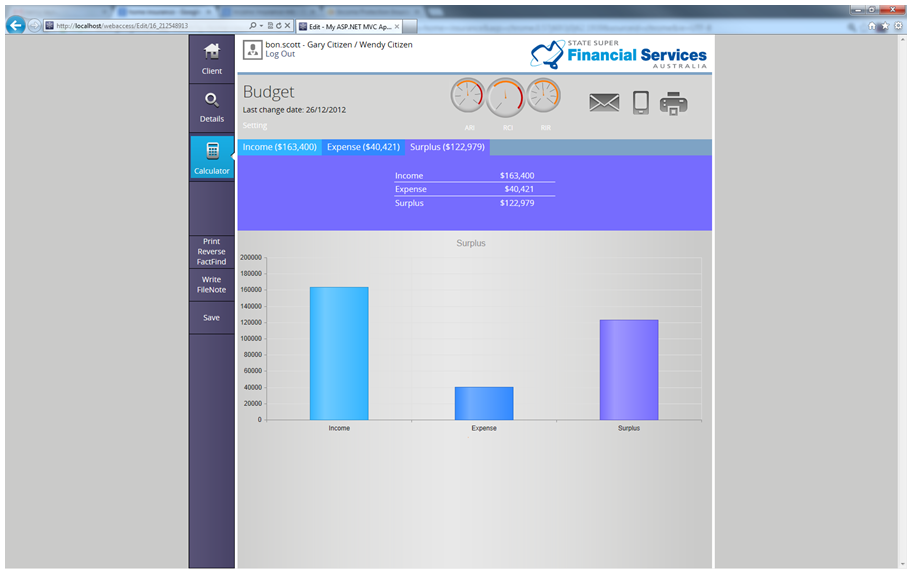

Budget Calculators

Are you spending more than you earn? Use this calculator to see if you have surplus income to put towards superannuation for retirement or insurance.

The calculator will allow the user to determine where there money is being spent. The calculation outputs look at the effect on disposable income from income from taxation, superannuation, Medicare levies, centre link benefits and general expenses. The calculator will provide an indication of surplus income that can then be used to provide for your retirement or protect your family from financial loss using insurance products.

** User note: Same as the budget in the details (fact find section).

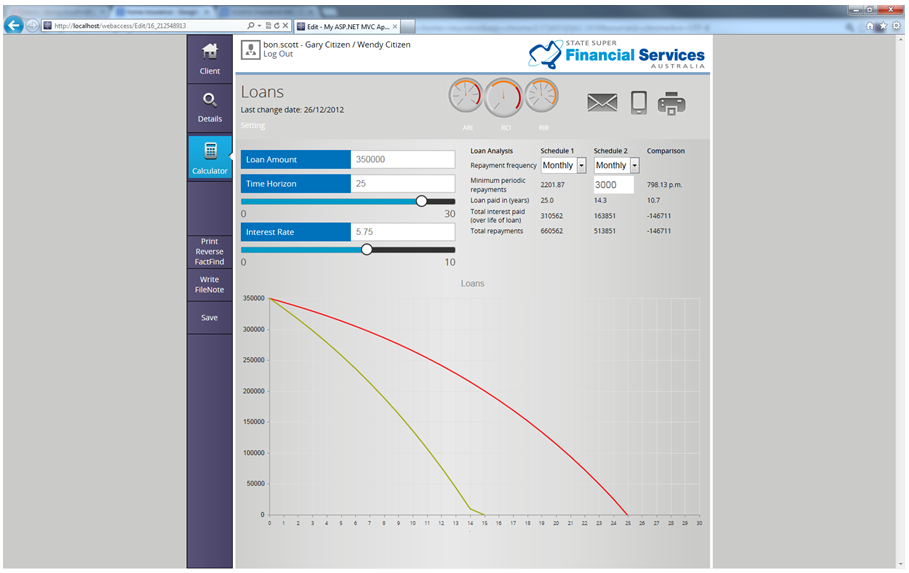

Loan Calculator

How long before I am debt free? Adjust your repayment to see how quickly your loans can be paid out.

The loan calculator compares the time it takes to pay down your loans by varying repayment amounts and the timing of repayments. The user can alter the loan amount, term, interest rate, repayment amounts and the frequency of repayment.

This calculator provides estimates only, to find out exact amounts to achieve your desired outcome you should speak to your lender or your financial adviser. The calculator outputs are true only for the example given and may not include all fees and charges applied by the lender. Various terms and conditions apply to loans and lending arrangements. These differ significantly depending on your lender. Consult your lender or financial institution for more information. Penalties may also be applied by lenders for early full or partial repayments on particular loans.

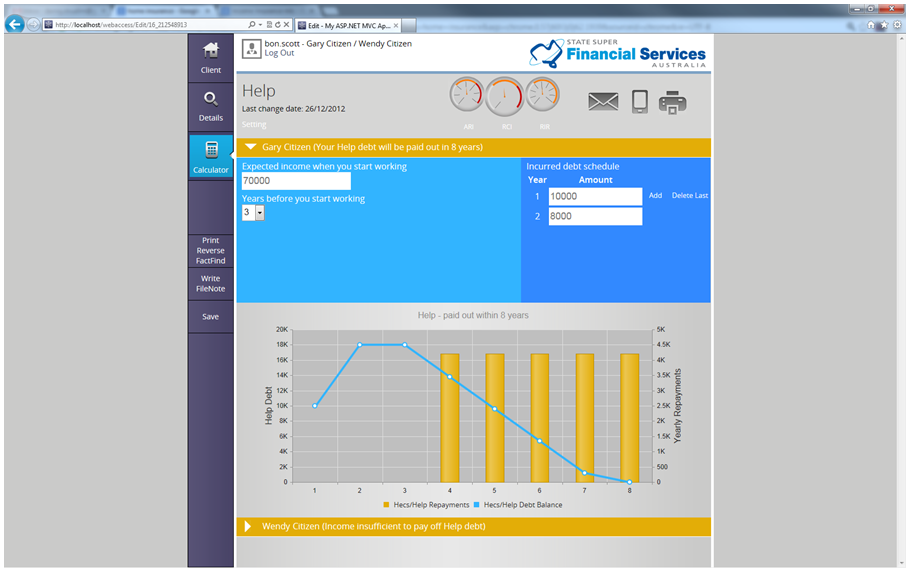

Help

This calculator is for people with student loans provided by the Australian Government (HECS or HELP). This calculator will determine how the repayment of your HELP debt will impact your future disposable income.

Currently the rate of repayment on HELP debts is determined by your Taxable income plus any total net investment loss (which includes net rental losses), total reportable fringe benefits amounts, reportable super contributions and exempt foreign employment income. Repayments of HELP debts are compulsory above a certain income threshold.

Education

Are you contemplating private schooling for your children? Use this calculator to determine the total cost of educating your children.

The education calculator allows parents to calculate the expected future cost of their children’s education and its impact on their disposable income. The calculator has the functionality to model multiple children over their primary, secondary and tertiary educations. In addition to this the calculator can model the effect of inflation through the indexation of fees and an expected return on capital for a savings plan.

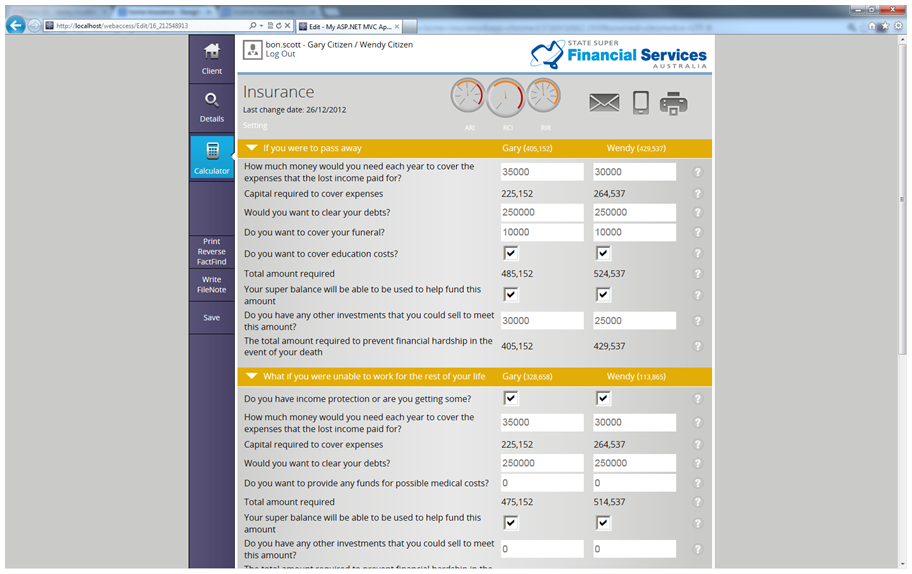

Insurance

What if something bad happens to me? See how much cover you require for injury, illness and death.

Personal insurance could provide a vital financial lifeline for you or your loved ones in the event of death, terminal illness or injury. The calculators help determine how much cover you require for death, total & permanent disability (TPD), critical illness (trauma) and salary continuance insurance.

The calculator helps determine the level of insurance you may require based on your financial situation. Important aspects of that should be included when determining your insurance requirements include ongoing household expenses, debts and your current level of income. An insurance gap exists when your current insurance (if any) is insufficient to maintain your family’s lifestyle in the event of sickness, accident or death.

There are four types of insurance that are covered within the calculator:

❄Death cover is lump sum cover that may be payable in the event of death

❄Total & permanent disability (TPD) cover is usually payable if you suffer an illness or injury that deems you permanently unable to return to work. Typically this type of cover is combined with death cover

❄Critical illness (trauma) pays a lump sum if if you suffer a serious illness or injury

❄Salary continuance insurance is also known as income protection. It will usually pay in monthly instalments, usually up to 75 per cent of your salary if you are temporarily unable to work through illness or injury

** User note: The cover analysis questions customisable in the database.

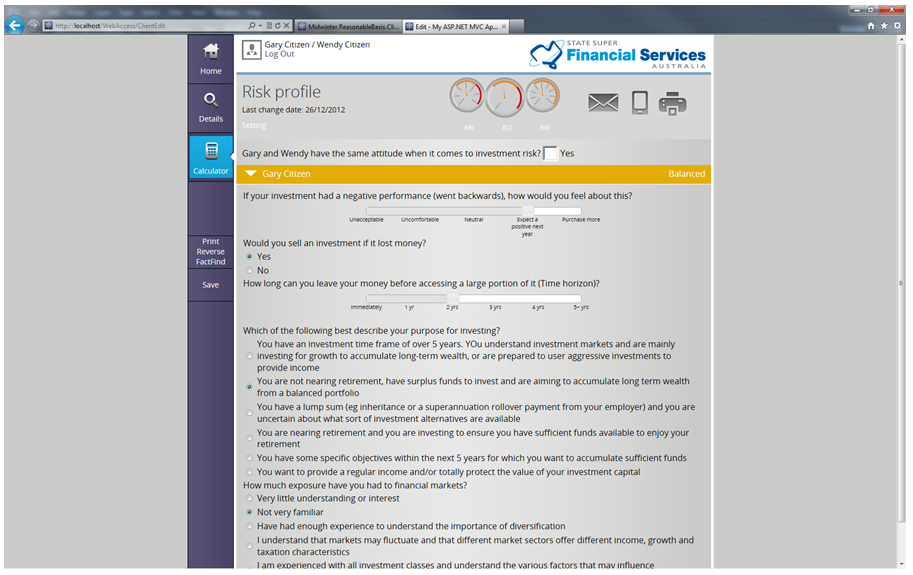

Risk profile calculator

How worried are you about the risks associated with investing? Answer a few simple questions to determine your appetite for risk.

Knowing what sort of investor you are will help you choose investments and determine the amount of risk you are prepared to take, and the returns you can expect. Risk profile calculator will help you work out what sort of investor you are and the sorts of investments that are right for you.

Risk profile calculator is for general illustration purposes only. The results and are not intended to be an accurate representation of the relationship between risk and return. The calculations and outputs are based on the limited inputs you provided by the user and the built-in assumptions. This calculator only generates factual information about an investment choice. It does not constitute a recommendation or statement of opinion about investing and is not intended to be relied upon for the purpose of making a decision in relation to a financial product. The calculator only considers a limited range of issues relevant to investing in superannuation it does not consider all of your personal circumstances.

** User note: Dealergroup specific – all details (Questions, Question Type, Answers, scores, score ranges) can be edited by the dealergroup.

Compare platforms

Are you paying too much in fees to your superannuation provider? Compare the fees charged between a variety of superannuation platforms.

The calculators allow you to input you superannuation balance information to provide a guide on the cost associated with your current superannuation platform versus an alternative platform.

The fees are based on Midwinter’s interpretation of the administration or account keeping fees (less any commissions paid from those fees to advisers) as presented in the product disclosure documents for these platforms. It should be noted that these disclosure documents may not be current as at the date of viewing these figures and comparisons.

The true total costs payable in relation to a platform may be greater or less than those specified in the comparisons. The information contained in these comparisons is given in good faith and has been derived from sources believed to be accurate. The outputs should be considered general information only and should not be considered and should not be relied upon as such. Midwinter or its client nor any of their related entities, employees or directors gives any warranty of reliability or accuracy of the information or calculations. Further to this Midwinter or its client do not accept any responsibility for errors or omissions. The charts and comparisons do not constitute the provision of a recommendation or statement of opinion. In addition to this they are not intended to influence any person in making a decision in regards to a financial product. The outputs should not be considered general or personal financial product advice.

Super Optimiser

The purpose of the Super Optimiser is to show you how making extra contributions to your super can help you reduce tax and improve income in retirement. The calculator also indicates the best way for you to contribute to super based on your salary. There are two ways you can contribute to super with either pre-tax money (using salary sacrifice) or after tax money. Our 'Salary sacrifice calculator' helps you compare these two methods by showing the net effect on your take home pay and on your super contributions.

The calculator has not taken into account your lifestyle expenses and other commitments like a mortgage or personal loans. You should consider whether these debts should be paid off before putting money into super, which you generally cannot access until you retire.

The information resulting from the calculations should not be relied upon as a true representation of any actual superannuation entitlements or benefits from any particular scheme or relied on as a basis upon which to alter your financial situation. It has been prepared without taking into account your particular financial needs, circumstances and objectives. You should assess your own financial circumstances and needs before you make any changes to your financial affairs.

The results of the super optimiser are based on predetermined assumptions. The Investment returns used are not guaranteed in any way and should not be relied upon. A licensed financial adviser and tax professional should be consulted to obtain advice specific to your individual needs and circumstances. Fees and Charges may apply to superannuation products. The graph provided is for illustrative purposes and is not designed to provide you with any specific financial results.

Defined benefit

Show how making extra contributions impacts your benefits in retirement and your current take home pay.

A defined benefit account gives you a package of benefits and uses a formula of a multiple times your salary to calculate your retirement benefit. This type of product is typically no longer available to new investors. They are also significantly different form a regular accumulation style superannuation account.

The key feature of a defined benefit schemes is that your benefit is based on a fixed calculation. This calculation is based on your salary times a multiple that grows each year of contributing membership. The more you pay towards you defined benefit scheme, the faster your multiple grows.

Pension drawdown

Have a pension and not sure how much to draw out of it? This calculator will show how long your pension will last by drawing different amounts.

The calculations are based on your expected retirement age. The calculator accesses how long your pension will last for based on your life expectancy and your income requirements in retirements. The level of drawdown form your pension is subject to a minimum amount. Included in the calculations is income from other sources (ie rental property) .These other income sources may reduce the income drawdown from your pension. The calculations take into account expected aged pension Centrelink benefits.

If you are the super accumulation phase or nearing retirement these calculators can be call to action to start contributing more to super.

This is a calculator provides calculations based on assumption and is not a prediction of how you will fair in retirement. Results are only estimates and the actual amounts may be higher or lower. We cannot predict things such as movements in investment markets.

Centrelink Aged Pension Calculator

Are you eligible for the age pension? Are you maximising your benefits the Centrelink ? This calculator will determine your likely entitlements - especially for those that are on a part pension.

You are generally eligible for the aged pension if you qualify under the income and assets test that is applied by Centrelink. This calculator is a basic guide to estimate Centrelink payments. Centrelink determines your actual payments. Changes to policy, the law, your circumstances and future events may mean that the payment you actually receive differs from the amount estimated.

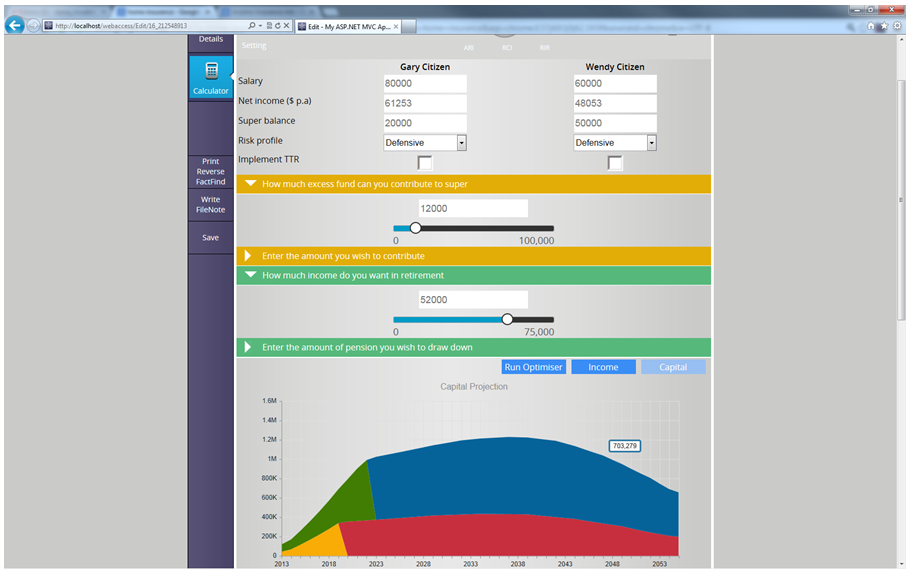

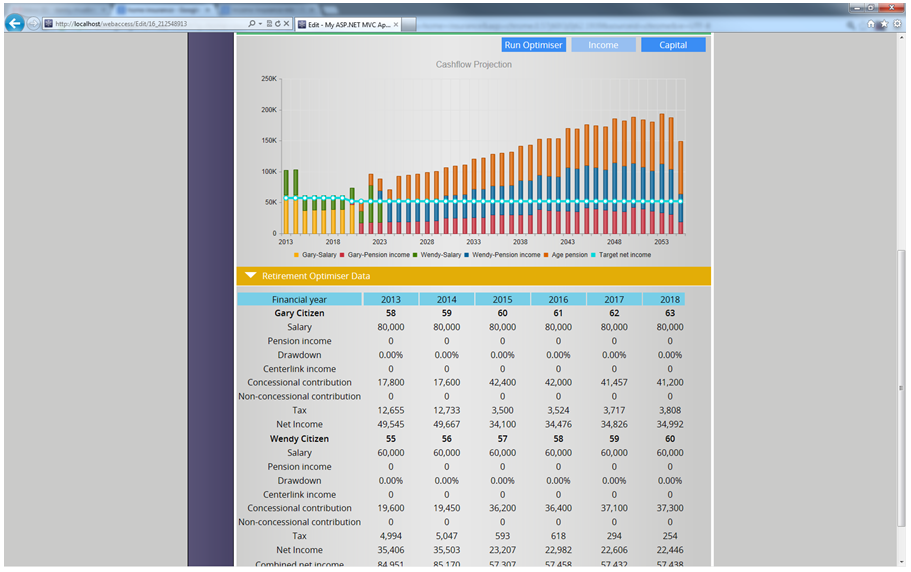

Retirement optimiser

Can you retire comfortably? – This calculator shows when you can retire and on how much income. It produces your Retirement Comfortability Index (RCI) which tracks your progress each year.

The retirement optimises your superannuation balance in retirement based on how much you (and your partner) can afford to contribute to your super while maintaining a certain level of disposable net income. The calculator will then aim to achieve this by providing an optimal contribution strategy while taking in account the effect of tax and other contribution strategies available such as transition to retirement. The calculator will then work out how long your desired income can be maintained in retirement while including the potential Centrelink aged pension payments applicable.

The calculator is flexible enough to also optimise your desired pension draw down in order to achieve a desired level of combined net income in retirement while optimising Centrelink payments between couples

** User note: Two simple sliders that optimise contributions and drawdowns.

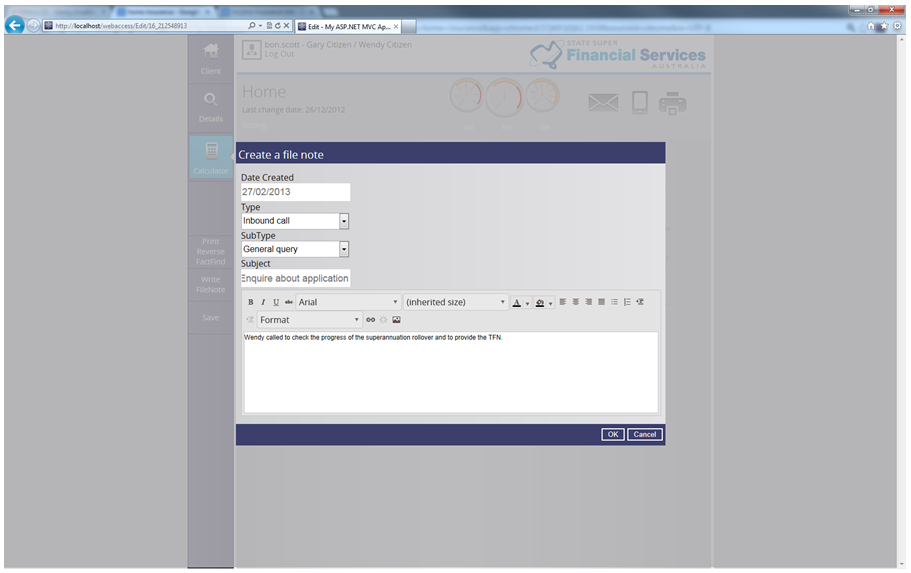

File Note – (Adviser only)

Allows an adviser to write a file note and attach a document to that note.