Needs Analysis

The AdviceOS Needs Analysis module provides you with an insurance tool set to enable you to calculate the amount of cover your clients require and recommend suitable policies.

The needs analysis module enables you to establish how you, as an adviser, have arrived at the required sum insured before you provide your clients with any advice product recommendations.

Analysis

The client details and needs analysis section shows your clients’ details as entered in the fact find section in Edit client. The Needs analysis module gives you the ability to calculate types of cover and amounts required for Life, TPD, Trauma and Income Protection.

Should any client details need to be updated, complete these changes through the Edit client module.

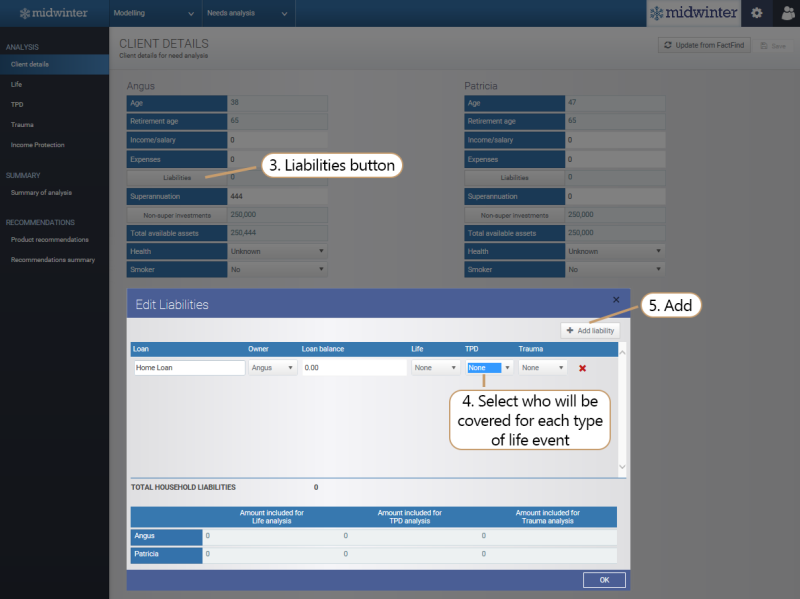

Calculate insurance needs to cover liabilities

1.Select client

2.Click “Needs Analysis”

3.Click “Liabilities” button

4.Select liability to be covered in the Edit Liabilities pop-up window for the type of life event and who will be covered (if part of couple)

5.Click “Add” to add additional liabilities

6.Click “OK”

The information entered will now flow through to the Needs Analysis

Figure 4.2.3.1.1

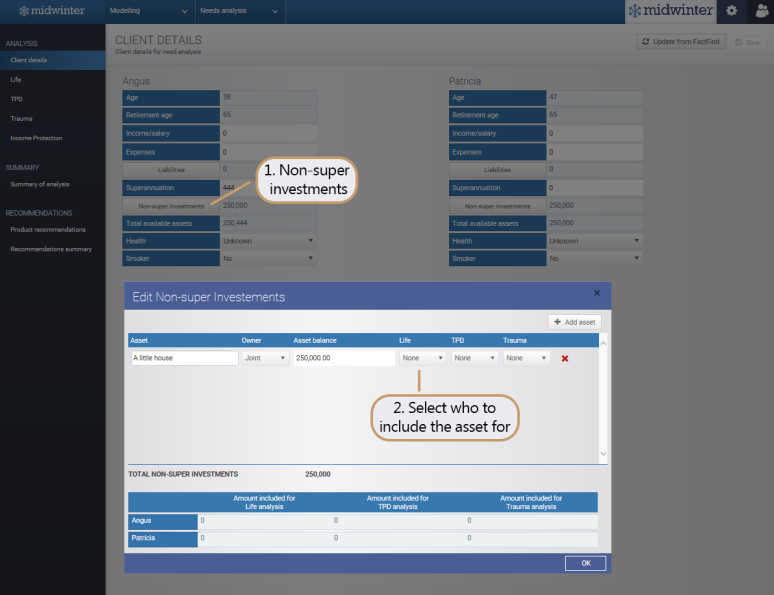

Adding non- super investments

If your clients hold assets directly for which they are able to self-insure in the event of a Life, TPD or Trauma claim, you can deduct this from the required amount for your needs analysis.

1.Click Non-super investments

2.Select who to include the asset for in the needs analysis in the event of a claim

3.Click “OK”

Figure 4.2.3.1.2

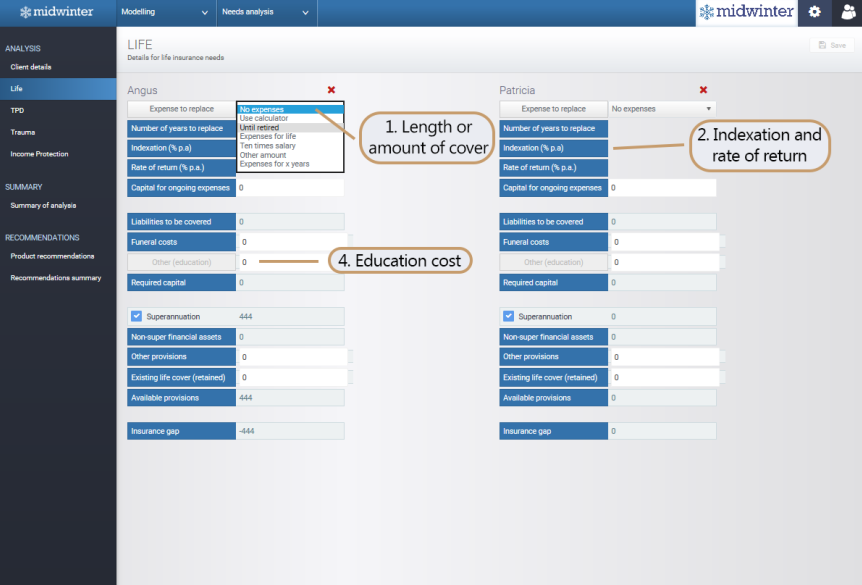

Including expenses cover for Life, TPD or Trauma

1.Click on dropdown box to select length or amount of cover required

2.Amend indexation and rate of return if required

3.Enter other costs such as funeral or medical costs

4.Enter education costs manually or click on “Other (education)” to calculate capital required to fund education expenses

5.De-select superannuation if you do not require this to be included in the needs analysis

Figure 4.2.3.1.3

Expense scenario manager

To make your own calculations of regular payments to provide the estate with, click the “Expenses to replace” button which opens the Expense Scenario Manager pop-up window

1.Click “Expenses to replace”

2.Enter annual amount required, until age (year) and Index

3.To add further annual amounts required, click “Add”

4.To start scenario from current age of other partner, click radio button of the individual to select

5.Rename, add rate of return and any residual value if required

6.To add further scenarios, click “Add”

7.To view a graph to illustrate the account balance and the amount the client will receive, click the “Expense capital amortisation” tab and compare the scenarios if required

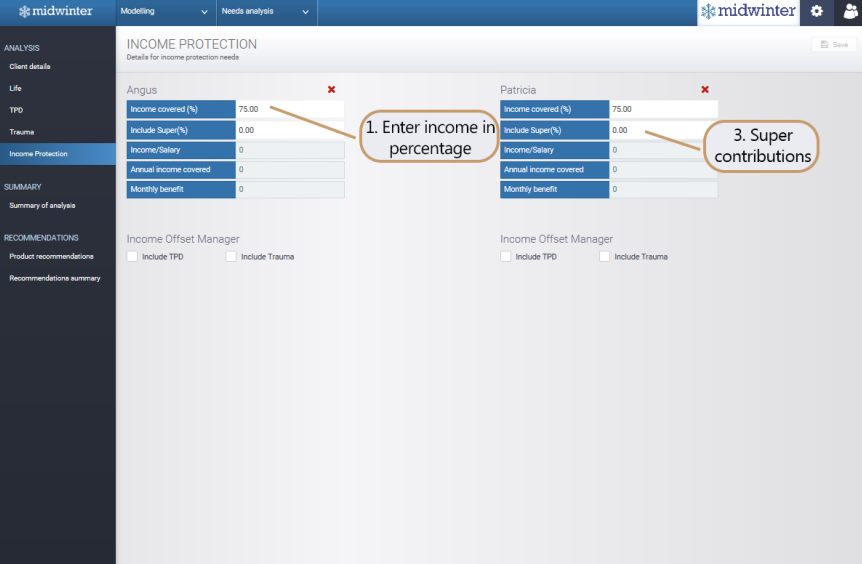

Including expenses cover for Income Protection

1.Click Income protection tab

2.Enter income to be covered in percentage

3.Include super contributions if required

Figure 4.2.3.1.4

Summary

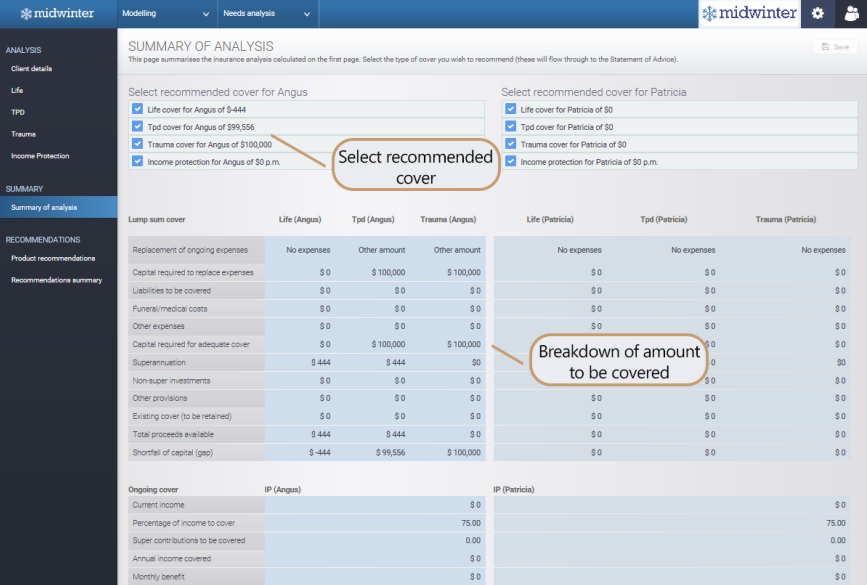

The summary of analysis section shows you the summary of the advice you are providing to your client as entered in the client details and needs analysis section.

Here you can select the type of cover you wish to recommend for your clients to flow into the SOA as well as a breakdown of how you have arrived at the sum you recommend to be insured.

Figure 4.2.3.1.5

Recommendations

In the product recommendations summary you can add the products you are going to recommend to your client through the Insurance Comparator.

Information on how to perform an insurance comparison can be found in the Insurance Comparator part of this document.

Recommendations summary

In the recommendations summary section you can view a summary of the insurance policies by owner and the benefit amount by insured. The dropdown box enables you to switch between the different insurance statuses to view recommended, inforce and any alternative scenarios.