Invest to Invest

The investment analysis module works in a very similar way to the product comparison modules for Pension and Super.

In the Invest to Invest module you can compare any fees of any number of existing and recommended investment portfolios. This module includes a preloaded list of the ASX 200 and all ASX shares.

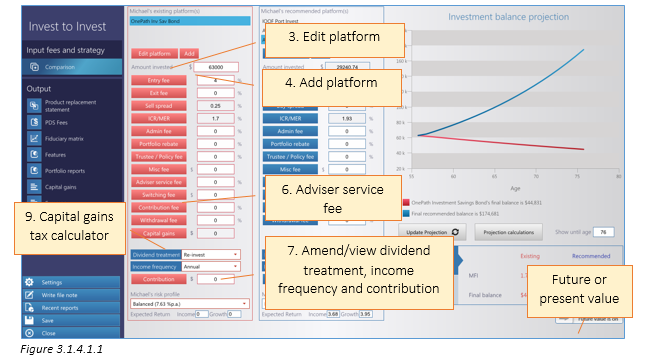

Editing and adding existing platforms

1.Select client

2.Click “Invest to Invest”

3.To load a platform from the Midwinter database or add a custom platform, click “Edit platform” (tick appropriate radio button) and select platform. From the edit platform button you can also choose to Delete, Rename or access platform settings to manually amend insurance premium inflation rate

4.To add a new platform, click “Add”

5.Enter amount invested

6.Enter any adviser fee or charges that were charged under “Adviser service fee”

7.Click “ICR/MER” or “Sell spread” to enter the investment options for your client in Portfolio Builder. Enter the client’s existing investments and amounts or percentage of each investment option, click “OK” and the weighted average MER is then automatically inserted

8.Add existing dividend treatment, income treatment and contribution for each investment product

9.Click “Capital gains” to use the Capital gains tax calculator

Click the Fee buttons to display different alternatives to view/enter fee calculations.

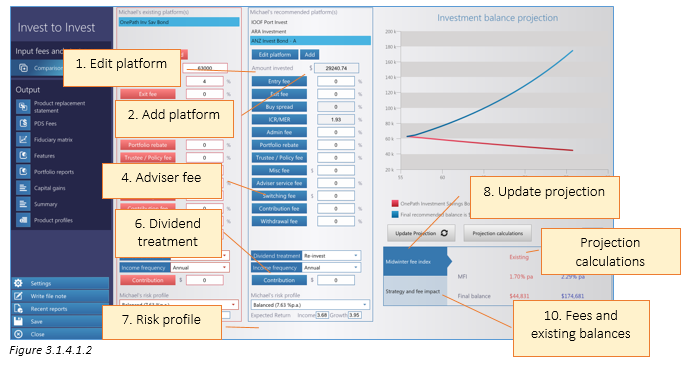

Editing and adding recommended platforms

1.To load a platform from the Midwinter database or add a custom platform click “Edit platform” (tick appropriate radio button) and select platform. From the edit platform button you can also choose to Delete, Rename or access platform settings to manually enter insurance premium inflation rates for the existing and recommended platforms

2.To add a new platform to perform an investment product comparison, click “Add” and “Add” again and “Load platform” (repeat to add additional platforms) and enter amount to invest in the Allocate funds window pop-up, ensuring you allocate 100% of the total amount between the funds

3.Enter amount to invest

4.Enter any adviser fee or charges you wish to include for the recommended platform

5.Click “ICR/MER” or “Buy spread” to use portfolio builder. Enter the client’s recommended investment options and amounts or percentage of each investment option, click “OK” and the weighted average MER is then automatically inserted

6.Add dividend treatment, income treatment and contribution for each investment product for the recommended platform(s)

7.Ensure the risk profile is correct for the recommended platform(s)

8.Click “Update projection” to view the investment balance projection

9.Click Projection calculations to view a detailed projection report on existing and recommended platforms

10.View MFI in percentage per annum and strategy and fee impact of switching investment platforms

11.Press “Save” to save the analysis

** User note: A maximum of two pension platforms can be added to an existing and recommended platform.