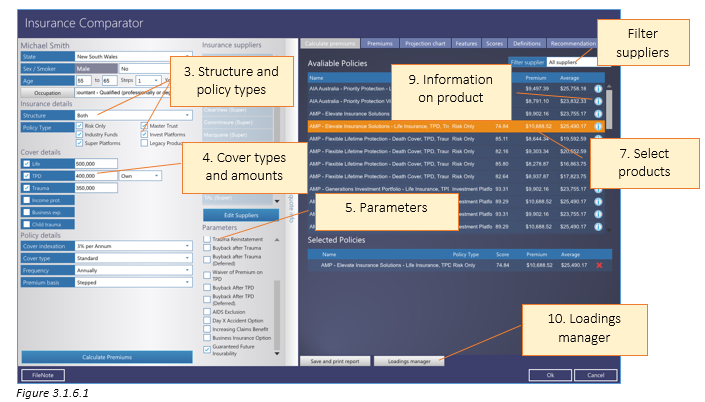

Insurance Comparator

In the Insurance comparator you are able to compare insurance fees, premiums and features for a range of suppliers for all insurance products.

All the features, scoring and definitions are aligned to allow a like- for -like comparison of all products in the Rice Warner universe of research insurance policies.

The structures available for insurance comparison are:

❄Ordinary

❄Super

❄Both

❄Hybrid- this refers to a policy that has some cover inside of super and some outside of super. Hybrid can also refer to flexi-linked policies. A hybrid policy attempts to implement as much cover through super as possible

There are many combinations around the structure, policy types and variations of cover types, however not all combinations are possible.

For example:

❄Clients cannot have a structure of Super and cover including trauma ( however clients can have a hybrid)

❄Users cannot have business expenses through super

❄Users cannot have a structure of ‘Ordinary’ and a policy type of super platform

AdviceOS manages the above restrictions by making certain policy and cover combinations unavailable when selecting a structure.

Comparing insurances and calculate premiums

1.Select client

2.Click Insurance comparator

3.Select the structure and policy type(s) required

4.Select Cover types and amounts

5.Add parameters for the quote

6.Click “Calculate Premiums” to give you a full list of all insurance policies and products that match

7.Select the products you wish to compare

8.Click on the remaining tabs to start the analysis of the compared products

9.Hover over the information button for a summary on the strengths and weaknesses of the product and the minimum premium amount

10.To enter any additional premiums for selected policies, click “Loadings manager” and enter percentage of loadings

Remaining tabs

❄Premiums-displays the annual premiums for the selected products

❄Projection Chart- shows the premium projections in graph format and the average premium amount for the selected products

❄Features- shows the features for the products selected

❄Scores- shows the weighted score for each product selected based on their features and premiums

❄Definitions- shows a summary of the PDS and contains a link to the PDS from the insurance provider

❄Recommendation- this tab is where you add the recommended product and where you view any benefits gained or lost in the event of an insurance switch