Settings

The Global settings are inputs that do not vary from client to client. Changes at this level will flow down to each individual client and client analysis.

Any changes made to the global settings will flow through to all modules and changes include any saved analysis.

![]()

** User note: The rates that are installed are defaults only and must be altered prior to use.

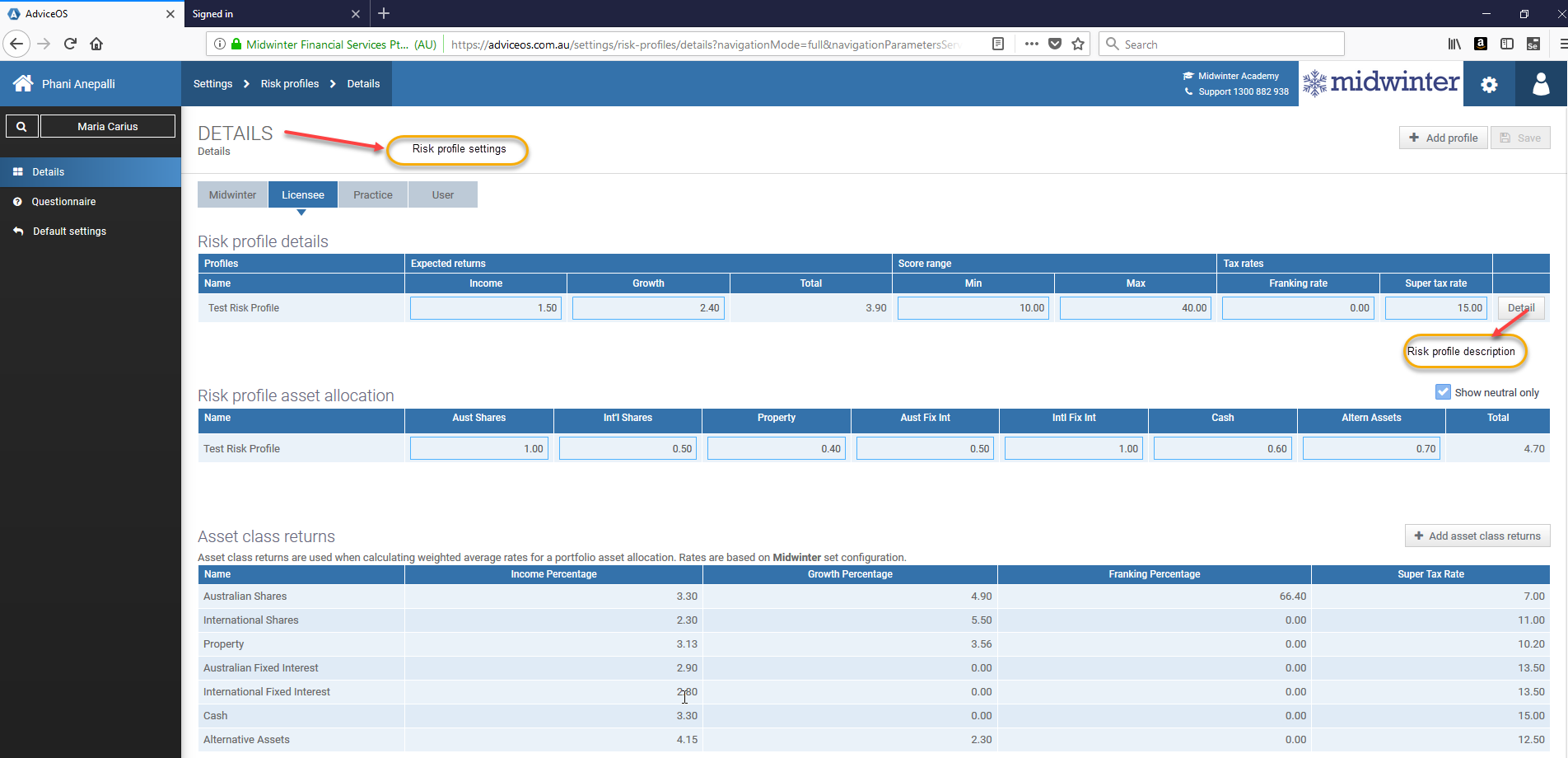

Risk profile settings

In the Risk profile Settings tab you can view and amend the asset allocation, expected returns and score range for risk profiles. In this tab you can also view a description of the risk profiles.

Figure 1.4.2.1.1

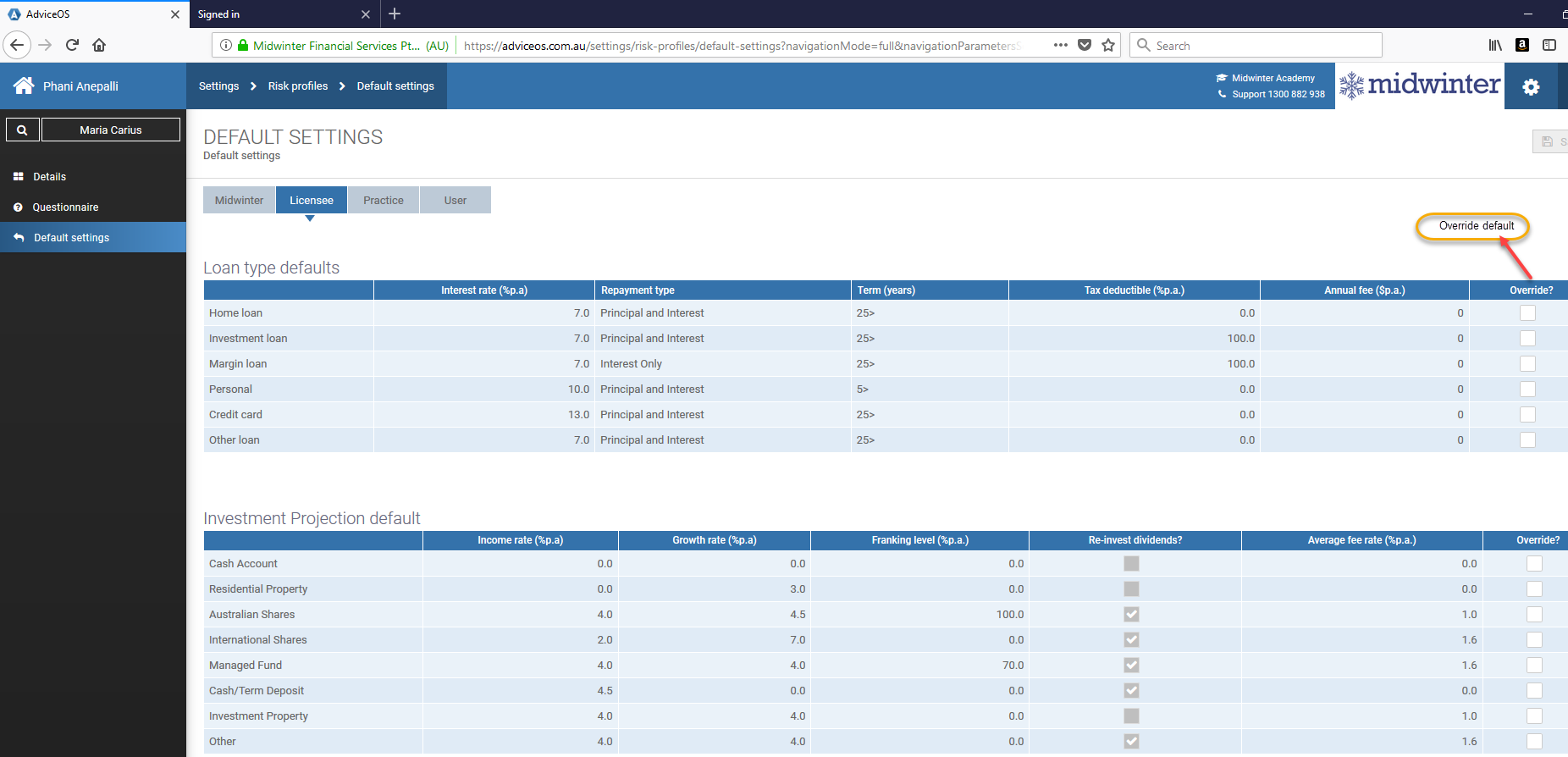

Default return settings

AdviceOS provides default information when a platform/product or loan is created in edit client or Cashflow and Capital (C&C). This information is then used to populate modelling data in C&C (automatically applied the first time to the default existing scenario). The user can then update the details from the fact find (manually) to any scenario they are working in C&C.

This topic outlines the default modelling data and the updating of C&C from fact find information.

At this stage the defaults are set by Midwinter – this will become configurable to each dealer group and practice in the global settings screen.

Figure 1.4.2.1.2

Default liability details that are used when a loan is created in edit client or in C&C.

** User note:

❄When a loan is merged or updated from the fact find – the fields above will be updated along with the loan name and current balance.

❄The monthly repayment amount will be updated to at least the minimum based on the current balance, interest rate, term remaining and repayment type.

It is particularly important to understand the default setting for investments as these will impact your modelling when or if they are copied from the fact find into the modelling section.

** User note:

❄The owner is set when the investment is created - there is no need to default this

❄When the investment is merged into C&C – the names, balances and fees are included

❄The cost base will be defaulted to the current balance

Superannuation and Pensions are treated differently to liabilities and investments because they are amalgamated into the one super fund in C&C (unlike loans and investments which remain separate). The main reason for this is to make modelling simpler as rolling over multiple super funds into TTRs and pensions etc will make the modelling extremely complex.

Furthermore, the return used in modelling is defaulted to the client’s prevailing risk profile return. So if the client has a risk profile of ‘Growth’ – the super or pension fund will use this has the default return. This can be updated in the modelling if required.

** User note:

❄The balances and prevailing risk profile returns are merged from the fact find

❄The concessional and non-concessional contributions from the cashflow will be imported and assumed to run to retirement

❄SG will be assumed at the prevailing rate (9.5% based on the salary from the cashflow)

❄The super earnings tax rate is 15% for income and 10% for growth

❄The pension drawdown rate will default to “minimum’

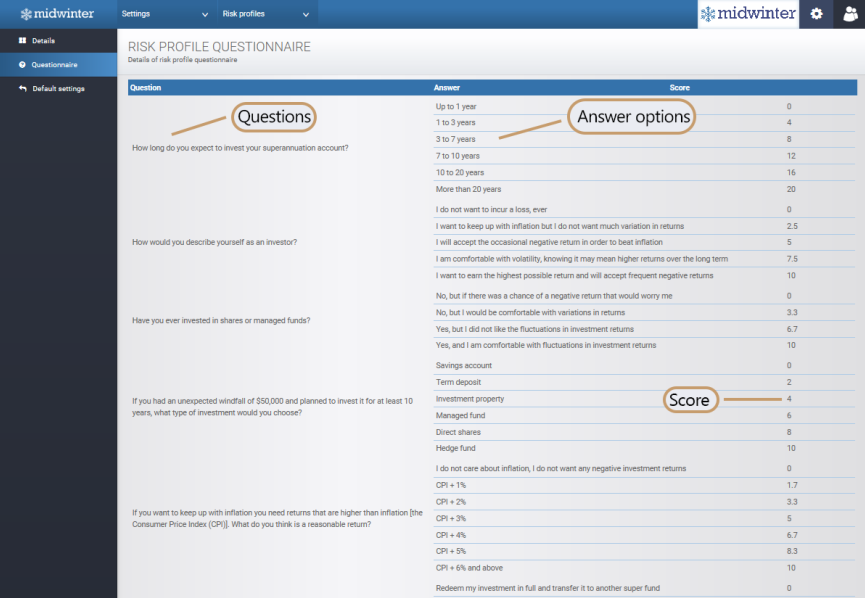

Risk profile questionnaire

The risk profile questionnaire shows the questions asked in the questionnaire and the score given for each answer.

Figure 1.4.2.1.3

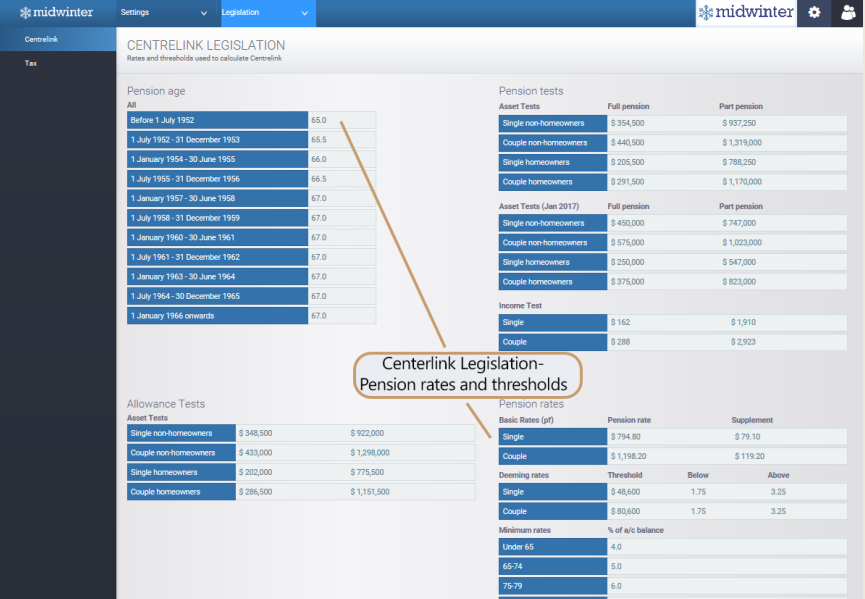

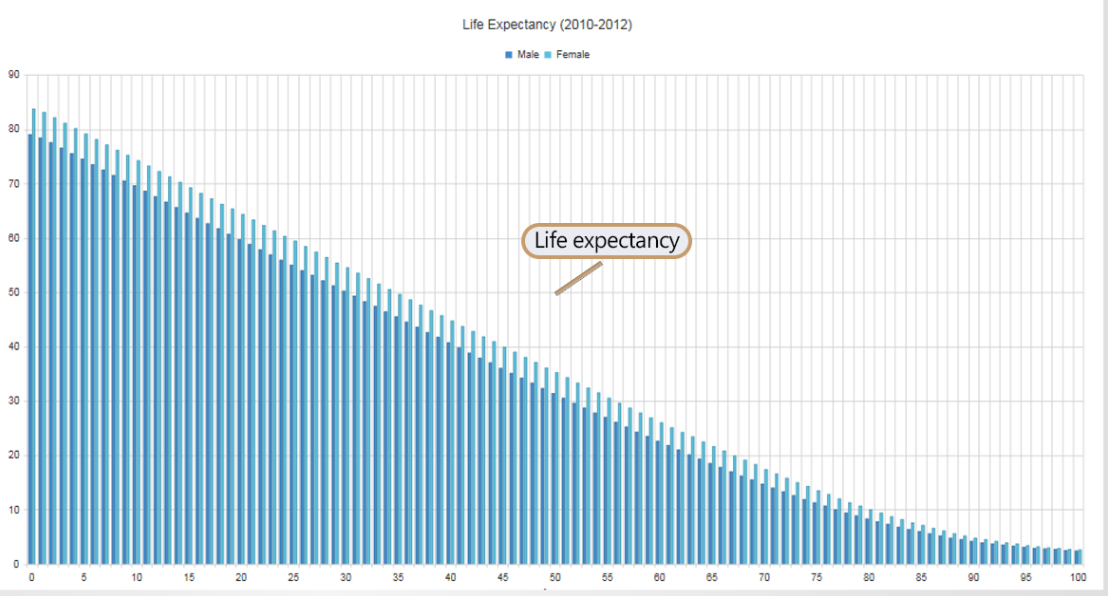

Centrelink Legislation

The Centrelink Legislation tab shows the legislation that is automatically applied to the advice Modelling in AdviceOS.

Figure 1.4.2.1.4

Figure 1.4.2.1.5

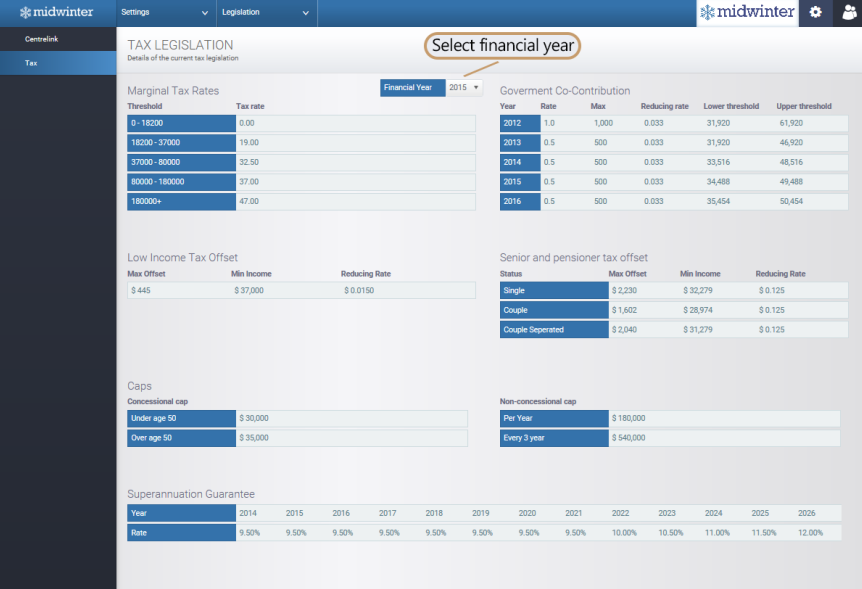

Tax Legislation

The tax legislation tab shows you the tax legislation that is applied to any analysis performed.

Figure 1.4.2.1.6