Commission/fee data for a Fee Disclosure Summary

This documents outlines the basics for making commission information available in the Fee Disclosure Summary. It outlines the process on how important FoFA dates are managed along with the creation and notification of the FDS.

Getting data from Commission/Easy Dealer report csv into AdviceOS

Each time a commission run is completed a report can be created in a format that can be read by AdviceOS. Currently, AdviceOS can read an Easy Dealer report automatically, however this can be easily adapted to read reports from any commission system (in a standard format).

The file is uploaded into the AdviceOS database (Secure online hosted by Amazon with Comodo SSL). The screen picture below is accessible by dealer level users (generaly only 1 or 2 per dealer group).

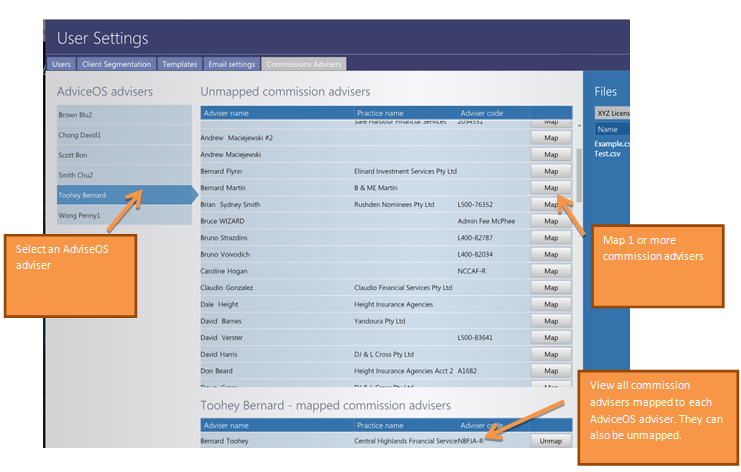

Mapping advisers from commission database to Adviser (users) in AdviceOS

The first task is to ensure that all advisers in the commission data are mapped to advisers in AdviceOS. This only needs to be completed once and is a simple matter of selecting an AdviceOS adviser and selecting one (or many) – commission data advisers that match.

Once mapped – only new advisers that come through the commission database will need to be mapped. At any time a dealer level user can check who is mapped to which adviser from the bottom section of the screen.

The only task on an ongoing basis is to upload the Midwinter easy dealer file and check to see that there are no new advisers to map.

Mapping accounts to clients/members

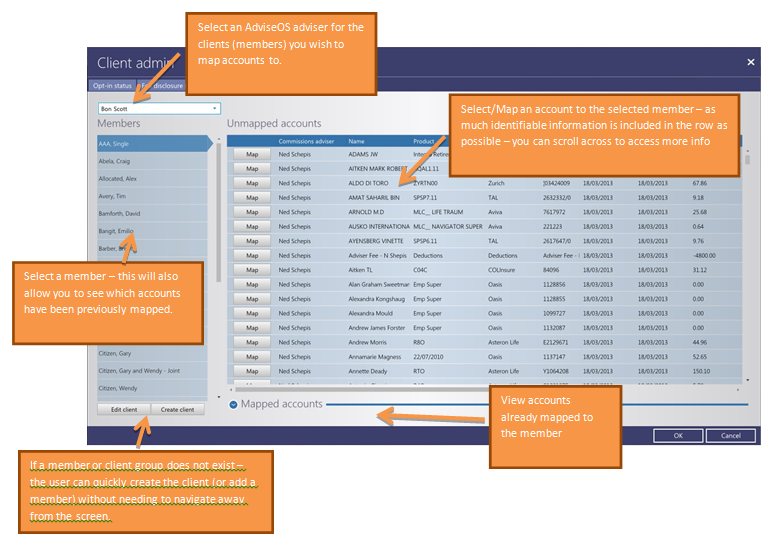

In AdviceOS a client group can consist of a primary client and a spouse along with any number of SMSF, companies or trusts. Each one of these is called a member of the client group. When accounts from the commission database are mapped, they are mapped to a member. This means that a SMSF owned account can be mapped to an SMSF member etc.

Once again, a mapping process will need to be undertaken. The initial mapping will take some time and depending on the number of accounts – this may be completed in a spreadhseet and merged in automatically (rather than going in and possibly mapping 100’s of accounts).

On an ongoing basis – after each commission run the adviceOS adviser can come into the screen below and see if there are any unmapped accounts that need to be allocated to a member. It is a simple task of selecting the member and then mapping the relevant account(s) to that member. Once again, you can also view all the accounts that have been previously mapped for each member.

The list of accounts includes all the available indentifiable informations as well as the ability to see if the account is active by the number of transactions and fee value in the last year.

Once an account is mapped to a member – it will no longer show up on the “unallocated list”. This will make it easy for a user to quickly check each commission run – if there are any unallocated accounts that have popped up since the commission run.

There will be occasions where an account does not have a member (or client group) to be assigned to… especially early on. In this instance, the user can create a client or add a member without needing to navigate away from the screen.

Extra functionality to come

Accounts can be marked inactive – this means that they will not show up on the list of unallocated accounts. It will be possible to make these accounts active again if required. This will be available in the first release.

At this stage Midwinter is not looking to auto map accounts to members. The main reason for this is the lack of clear identifiable information. The preference has been to create a very easy and user friendly interface that each adviser (or para planner/service user) can quickly map members and accounts on a regular basis (after the commission run).