Calculators

AdviceOS provides you with a range of calculators that can assist in providing your clients with calculations such as loan repayment calculations and education expenses calculations whether completed by yourself or your clients via the client portal.

In addition, AdviceOS calculators give you the ability to perform optimiser calculations for retirement, super and pension.

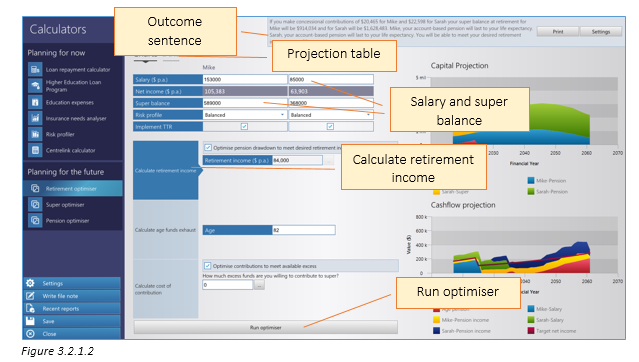

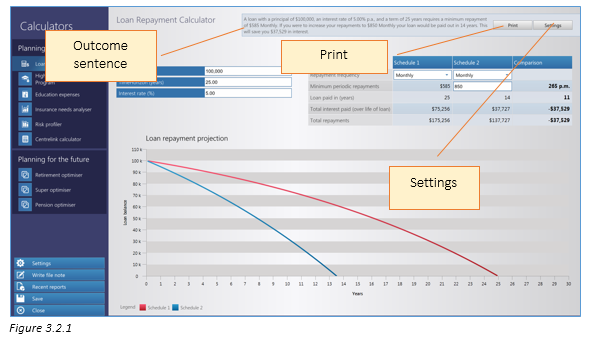

In the Calculators you are provided with a convenient outcome sentence based on the information entered which summarises the findings of the calculators in one sentence.

In the top right hand corner you are also able to access the settings where you can edit the assumptions and settings used for your clients’ situation.

The print option generates a report that can be uploaded to your client records and if required, shared with your clients.

**User note: Changing assumptions in the calculator settings will update the result in all calculators.

Planning for Now

In the planning for now section, the following calculators can be accessed;

❄Loan repayment calculator

❄Higher Education Loan Program

❄Education expenses

❄Insurance needs analyser

❄Risk profiler

❄Centrelink calculator

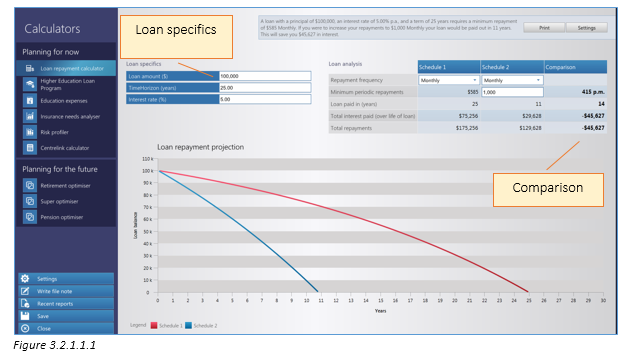

Loan repayment calculator

In the Loan repayment calculator you can calculate loan repayment projections and produce comparison calculations by editing repayment frequencies and repayments based on your loan amount, time horizon and interest rate entered.

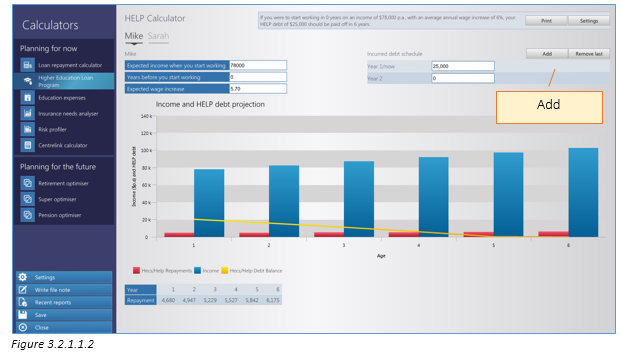

HELP Calculator

In the HELP calculator you can calculate client HELP/HECS repayments. By clicking “Add” you can add amounts of debt incurred split between different years.

Education Expenses

The education expenses calculator will calculate the capital required to fund education expenses.

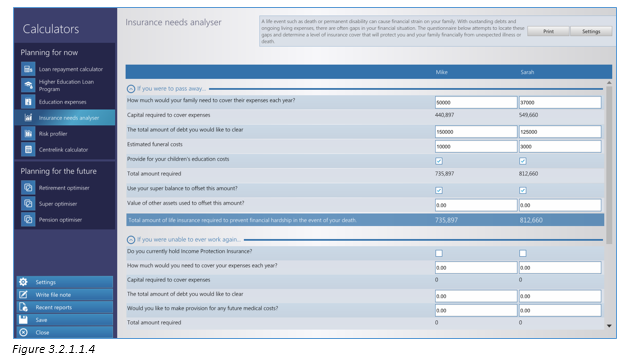

Insurance needs analyser

The insurance needs analyser tool is a calculator that identifies any gaps in your clients’ financial situation if significant life events were to occur. Completing the questionnaire locates the gaps and determines a level of insurance cover needed to protect your clients financially from unexpected illness or death.

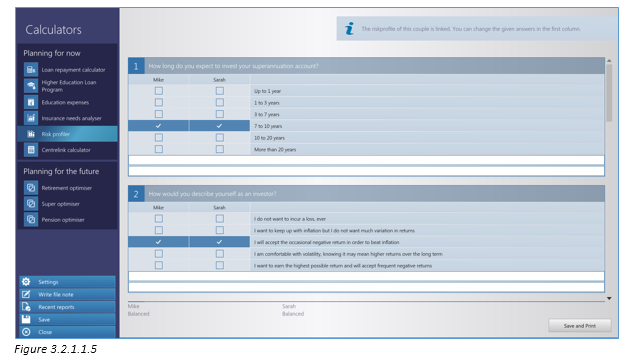

Risk profiler

The Risk profiler is the identical questionnaire accessible from the Edit client> Personal details tab.

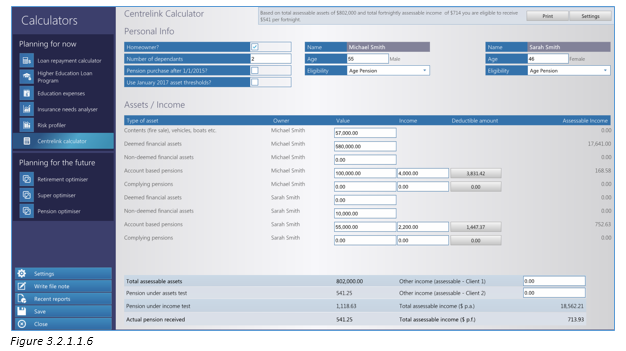

Centrelink calculator

In the Centrelink calculator you are able to calculate the assets and incomes for your clients and the effect on any Centrelink pension payments.

Planning for the future

In the planning for the future menus you are able to calculate the optimal strategies for retirement, super and pension.

The screens are split into two sections; Charts and Data.

To run the optimiser; enter salary details, super balance, select risk profile and implement TTR if required in the Charts section.

Clicking the optimiser buttons will calculate the optimal strategy and show you the capital and cashflow projection in a graph format along with an outcome sentence to summarise the findings of the calculations.

In the Data section of the optimisers you can view you clients’ cashflow and capital per financial year in a projection table.